Credit Union Cheyenne WY: Tailored Financial Solutions for Your Needs

Credit Union Cheyenne WY: Tailored Financial Solutions for Your Needs

Blog Article

Experience the Difference With Credit Score Unions

Subscription Advantages

Credit scores unions offer a range of valuable advantages to their members, distinguishing themselves from traditional financial institutions. Unlike financial institutions, credit report unions are had by their participants, that likewise have ballot civil liberties to elect the board of directors.

An additional considerable advantage of lending institution is their concentrate on neighborhood involvement and support. Many cooperative credit union proactively take part in neighborhood advancement tasks, economic education and learning programs, and philanthropic initiatives. By fostering a strong sense of neighborhood, lending institution not only give economic services however also add to the general wellness and success of the areas they offer.

Moreover, cooperative credit union focus on economic education and learning and empowerment (Credit Union in Cheyenne Wyoming). They offer sources and guidance to help members make informed decisions regarding their finances, improve their credit rating, and accomplish their long-lasting monetary goals. This commitment to education and learning collections credit score unions apart as relied on financial companions committed to the financial well-being of their participants

Individualized Client Service

Supplying tailored support and personalized interest, lending institution excel in supplying tailored client service to their participants. Unlike conventional financial institutions, cooperative credit union focus on developing solid partnerships with their members, concentrating on understanding their special demands and financial objectives. When a member engages with a credit history union, they can anticipate to be treated as a valued individual as opposed to simply an account number.

Cooperative credit union often have regional branches that allow for in person interactions, improving the personal touch in client service. Participants can talk directly with educated staff that are devoted to helping them browse monetary decisions, whether it's opening up a new account, getting a funding, or consulting on managing their financial resources. This customized method collections lending institution apart, as members really feel sustained and encouraged in achieving their financial goals.

Moreover, cooperative credit union also provide practical electronic financial solutions without compromising the personal connection. Members can access their accounts online or through mobile apps while still receiving the same level of individualized help and treatment.

Affordable Rates Of Interest

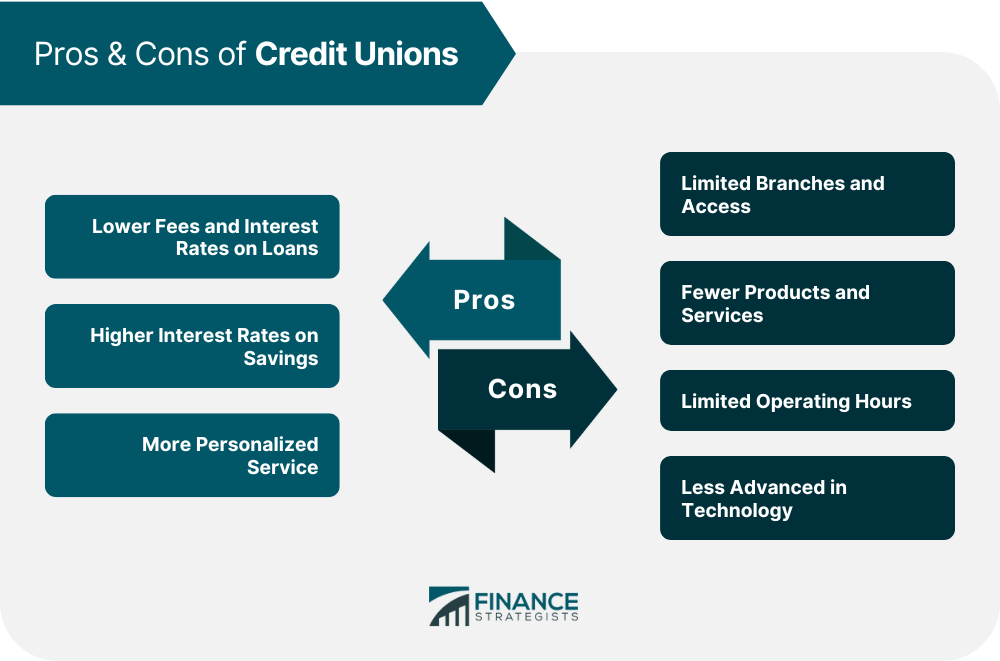

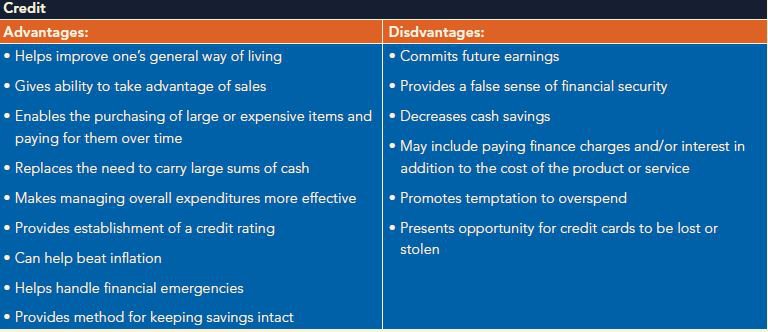

When looking for economic items, participants of cooperative credit union benefit from affordable rate of interest that can improve their cost savings and obtaining opportunities. Lending institution, as not-for-profit financial institutions, typically offer more desirable rates of interest compared to typical banks. These competitive prices can apply to various monetary items such as savings accounts, deposit slips (CDs), individual lendings, home loans, and debt cards.

One of the vital advantages of cooperative credit union is their concentrate on offering participants rather than optimizing revenues. This member-centric approach permits cooperative credit union to prioritize providing reduced rates of interest on finances and higher passion rates on interest-bearing accounts, offering participants with the chance to expand their money better.

Furthermore, credit history unions are known for their desire to deal with members that may have less-than-perfect credit report. Despite this, debt unions still aim to keep competitive rate of interest, ensuring that all members have accessibility to inexpensive economic services. By taking benefit of these competitive rate of interest, cooperative credit union participants can take advantage of their funds and accomplish their savings and borrowing goals extra efficiently.

Lower Fees and Expenses

One remarkable attribute of credit history unions is their dedication to minimizing charges and expenses for their participants. Unlike standard financial institutions that frequently prioritize making best use of revenues, cooperative credit union run as not-for-profit companies, permitting them to offer a lot more favorable terms to their members. This distinction in framework equates to lower charges and minimized expenses throughout different solutions, benefiting the members directly.

Cooperative credit union commonly bill reduced account upkeep charges, over-limit charges, and atm machine costs compared to commercial financial institutions. Furthermore, they typically supply greater rates of interest on interest-bearing accounts and lower rates of interest on financings, causing general cost financial savings for their members. By keeping fees and expenses at a minimum, credit history unions aim to provide economic services that are cost effective and easily accessible, promoting a more comprehensive monetary setting for individuals and areas.

Basically, picking a Credit Union in Cheyenne Wyoming cooperative credit union over a typical bank can lead to substantial cost financial savings in time, making it an engaging choice for those seeking an extra cost-effective approach to financial services.

Community Involvement

With a strong emphasis on cultivating dense partnerships and supporting regional campaigns, lending institution actively take part in area participation initiatives to empower and uplift the locations they offer. Community participation is a keystone of lending institution' values, mirroring their commitment to repaying and making a favorable impact. Lending institution often take part in different community tasks such as volunteering, funding local occasions, and giving economic education and learning programs.

By proactively taking part in area events and efforts, credit history unions demonstrate their commitment to the well-being and success of the areas they offer. This involvement surpasses just financial deals; it showcases a genuine rate of interest in constructing solid, lasting neighborhoods. Via collaborations with regional companies and charities, lending institution add to improving the high quality of life for residents and promoting a sense of unity and assistance.

Furthermore, these neighborhood participation efforts help to develop a favorable picture for credit unions, showcasing them as trusted and reliable partners bought the success of their participants and the community at huge. In general, neighborhood involvement is an important facet of credit unions' procedures, strengthening their commitment to social obligation and area development.

Verdict

Finally, lending institution offer numerous benefits such as democratic control, much better rate of interest, reduced funding prices, and reduced fees compared to for-profit banks. With customized customer care, competitive rate of interest, reduced fees, and a dedication to area involvement, cooperative credit union offer an one-of-a-kind worth proposal for their participants. Emphasizing economic empowerment and community development, cooperative credit union attract attention as a beneficial choice to standard for-profit banks.

:max_bytes(150000):strip_icc()/GettyImages-184268471-5bcba6ad46e0fb0051ae6958.jpg)

Report this page